Cambodia has emerged as a significant player in the global cashew industry, with production steadily increasing in recent years. The country’s favorable climate, fertile soil, and growing expertise in cashew farming have contributed to its rise as a key producer. Cambodia ranks among the top cashew-producing nations, with over 1.1 million tons of raw cashew nuts (RCN) exported in 2021.

Despite this impressive production, the majority of Cambodian cashew nuts are exported in raw form, primarily to Vietnam, where they are processed before being re-exported to international markets. However, with increased investment in local processing facilities, certification programs, and government support, Cambodia is positioning itself as a direct supplier of high-quality processed cashews to markets such as Europe and North America.

Cashew nuts play a crucial role in Cambodia’s agricultural sector, providing income to hundreds of thousands of smallholder farmers. The crop is mainly grown in the northeastern and central provinces, including Kampong Thom, Preah Vihear, Ratanakiri, Mondulkiri, and Kratie.

Key reasons for cashew’s importance in Cambodian agriculture include:

The cashew industry contributes to Cambodia’s broader economic development by creating employment opportunities, attracting foreign investment, and increasing export revenues. The Cambodian government has recognized the cashew sector as a priority for agricultural development, with initiatives like the National Cashew Policy (2022-2027) aiming to increase domestic processing and export value.

Key economic highlights:

With continued investment in processing, improved farming techniques, and expanded market access, Cambodia’s cashew industry is poised for long-term growth and global competitiveness.

The cashew tree (Anacardium occidentale L.) is a tropical evergreen that thrives in warm climates with well-drained soil. It belongs to the Anacardiaceae family, which also includes mangoes and pistachios.

Cambodia’s cashew trees are known for their high-yielding varieties, such as M23, which is weather-resistant and produces larger nuts.

The cashew tree produces multiple valuable products, making it an economically important crop.

Cambodia has become one of the world’s emerging cashew producers, thanks to its ideal climate, fertile soil, and expanding agricultural sector. The country has vast land suitable for cashew farming, and smallholder farmers play a crucial role in production.

Cashew trees thrive in warm, tropical climates, making Cambodia an ideal location.

Cashew farming in Cambodia varies from traditional low-maintenance methods to modern techniques focused on quality and yield.

The shift toward modern, high-quality farming is helping Cambodia compete in international markets and reduce reliance on raw exports.

Despite its growing success, Cambodian cashew farming faces several challenges that impact productivity and quality.

Cambodia is home to several cashew varieties, each with distinct characteristics in terms of yield, nut size, taste, and resistance to weather conditions. The most widely cultivated variety is M23, but other varieties like H09, M1, M10, and IM4 also contribute significantly to production.

| Variety | Flowering Period | Yield (tons/ha) | Nut Size (unshelled nuts/kg) | Outturn (Kernel-to-Nut Ratio) | Key Characteristics |

|---|---|---|---|---|---|

| M23 | Mid-Nov to Feb (flowers 2-3 times/year) | 1.5 – 2.6 | 110-130 nuts/kg | 28-33% | - Most widely grown (70% of total production) - Large nut size - High yield - More resistant to weather but requires more maintenance |

| H09 | Late Nov to Early Jan | 1.3 – 2.4 | 120-150 nuts/kg | 28-32% | - Good kernel quality - Single flowering per year - Medium resistance to drought |

| M1 | Nov to Feb | 1.2 – 2.1 | 130-160 nuts/kg | 26-30% | - Smaller nut size - Suitable for mixed cropping systems - Popular in specific regions |

| M10 | Nov to Jan | 1.4 – 2.3 | 125-140 nuts/kg | 27-31% | - High oil content - Preferred for processing into cashew butter or snacks |

| IM4 | Nov to Feb | 1.0 – 2.0 | 140-160 nuts/kg | 26-30% | - Moderate yield - Medium-sized nuts - Good adaptability to different soils |

| Market | Preferred Variety | Reason for Preference |

|---|---|---|

| Europe | M23, H09 | - Large nut size (better for snacks) - High kernel quality for premium markets - Sustainability interest (organic M23) |

| United States | M23, M10 | - Used in snacks and nut-based dairy alternatives - High demand for cashew butter and milk |

| Japan | M23, IM4 | - Preference for white, high-quality kernels - Strict food safety standards favor controlled cultivation |

| China & Southeast Asia | M23, H09, M1 | - Large nut size for snacks - Some demand for smaller varieties (M1) for processed cashew snacks |

M23, H09 – Large nut size, high kernel quality, organic preference

M23, M10 – Used in snacks, nut-based dairy alternatives, cashew butter

M23, IM4 – Preference for white, high-quality kernels, strict food safety standards

M23, H09, M1 – Large nut size for snacks, demand for smaller varieties in processed cashew snacks

Cambodia’s M23 variety dominates cashew production and exports, thanks to its large nut size, high yield, and adaptability to local conditions. Other varieties like H09 and IM4 are gaining recognition in specific markets, especially where high kernel quality and oil content are valued.

As global demand for premium, organic, and sustainably sourced cashews increases, Cambodia has a competitive advantage in offering high-quality, large-kernel cashews to premium markets such as Europe, the U.S., and Japan.

To successfully compete in global markets, Cambodian cashew nuts must meet strict quality standards and obtain relevant certifications. Buyers, especially in Europe, the U.S., and Japan, prioritize size, color, moisture content, and food safety compliance when selecting cashew nuts.

Cashew nuts are classified based on size, appearance, and processing quality. The grading system follows international standards, with whole nuts (W) and broken pieces categorized separately.

| Grade | Common Name | Nuts per 1 lb | Characteristics |

|---|---|---|---|

| W-180 | King of Cashews | 170-180 | Largest, premium quality, high-priced |

| W-210 | Jumbo | 200-210 | Large, high demand in premium markets |

| W-240 | Large | 220-240 | Well-balanced size and value |

| W-320 | Standard Export Grade | 300-320 | Most common in exports, mid-sized, high outturn ratio |

| W-450 | Small | 400-450 | Smaller nuts, more affordable |

| W-500 | Tiny | 450-500 | Least expensive whole nuts |

| Grade | Type | Description |

|---|---|---|

| SW | Scorched Wholes | Darker-colored whole kernels (due to heat exposure) |

| SSW | Scorched Seconds | Over-scorched or shriveled whole nuts |

| B | Butts | Broken halves of cashews |

| S | Splits | Lengthwise split kernels |

| LWP | Large White Pieces | Large broken cashew pieces |

| SWP | Small White Pieces | Smaller-sized broken pieces |

Cashew processing is a key step in adding value to Cambodia’s cashew industry. While Cambodia produces over 1 million tons of raw cashew nuts (RCN) annually, more than 90% are exported raw to Vietnam for processing. Increasing local processing capacity is essential for Cambodia to capture more value, create jobs, and gain direct access to international markets.

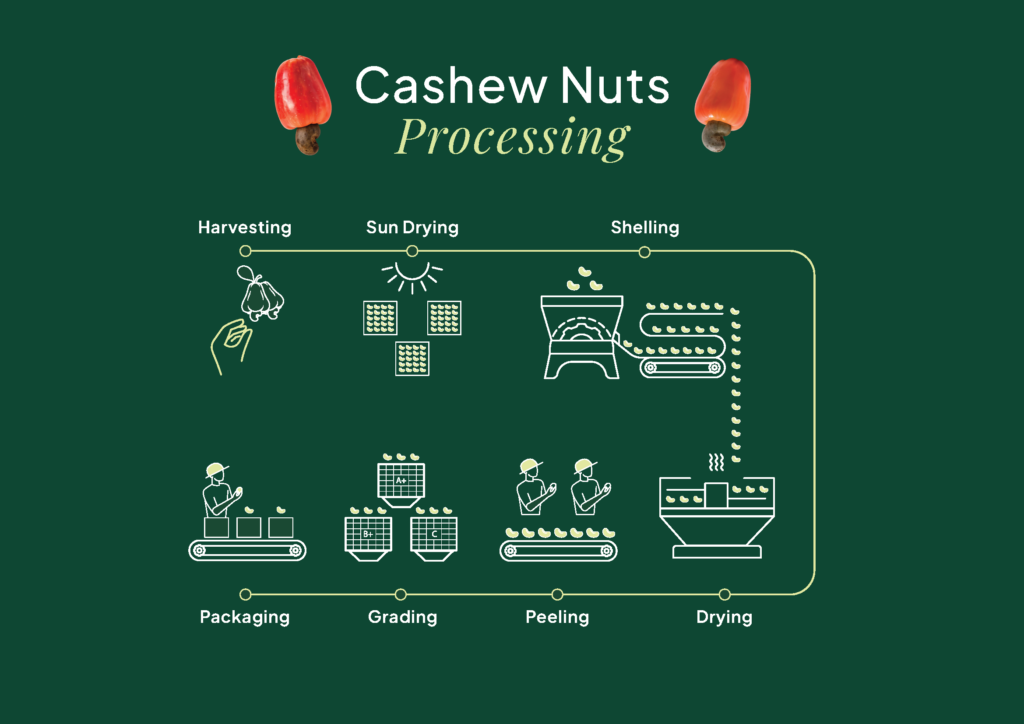

After harvesting, raw cashew nuts are sun-dried for 2–3 days to reduce moisture and prevent spoilage. They are then cleaned to remove dirt, debris, and foreign matter before further processing.

Shelling is one of the most labor-intensive stages due to the hard outer shell containing Cashew Nut Shell Liquid (CNSL), a caustic substance. In Cambodia, manual and semi-mechanical shelling are common, where workers crack shells using knives or hand-operated machines. While manual shelling is low-cost, it is slow and hazardous. Some factories use automated shelling machines, which improve efficiency and worker safety, but require high investment.

Once shelled, the kernels are dried again to loosen the inner skin before peeling, sorting by size and color, and grading (e.g., W-320, W-180, etc.). Processed cashews are then vacuum-packed or nitrogen-sealed to maintain freshness and prevent contamination.

Cambodia lacks large-scale processing facilities, forcing most farmers to sell raw cashews to Vietnam. Expanding local processing plants would allow Cambodia to capture more value.

Manual labor is expensive and slow, making it hard to compete with Vietnam’s automated factories. Additionally, exporting directly to premium markets (EU, U.S.) requires HACCP and organic certifications, which many small processors lack.

Investments in processing plants, mechanization, and certification programs are helping Cambodia increase direct exports to global markets. Expanding automated processing and quality control will further enhance Cambodia’s competitiveness in the cashew industry.

Cambodia is emerging as a competitive supplier of cashew nuts, but exporting requires a well-managed supply chain, reliable transport logistics, and compliance with international trade regulations. This section outlines the journey of cashews from farmers to international buyers, key shipping methods and Incoterms, and the challenges exporters face.

The Cambodian cashew supply chain involves several key players before the nuts reach international markets.

Vietnam: The largest buyer of Cambodian raw cashew nuts (RCN). Over 90% of Cambodia’s cashew exports go to Vietnam, where they are processed and re-exported.

Direct Exports: Processed cashews are increasingly shipped to Europe, the U.S., Japan, and China, offering higher profit margins for Cambodian exporters.

Trade Agreements: Cambodia benefits from duty-free or low-tariff access to major markets under trade agreements like RCEP (Regional Comprehensive Economic Partnership) and the EU’s “Everything But Arms” (EBA) trade scheme.

Key Takeaway: The Cambodian cashew supply chain is still heavily reliant on Vietnam, but direct exports of processed cashews are growing, offering new opportunities for exporters.

| Incoterm | Meaning | Who Covers Transport? |

|---|---|---|

| FOB (Free on Board) | Exporter delivers cashews to the port of departure | Buyer handles shipping & insurance |

| CIF (Cost, Insurance, Freight) | Exporter covers cost & insurance until destination port | Exporter |

| EXW (Ex Works) | Buyer picks up goods directly from exporter’s facility | Buyer handles all costs |

| DAP (Delivered at Place) | Exporter delivers goods to buyer’s specified location | Exporter |

High-quality, sustainably sourced Cambodian cashew nuts.

Building No. 07, 3rd Floor, Office No, C1 Street 496, Phnom Penh 120112

info@kingdomhubagro.com

Southeast Asian agricultural products to global markets, supporting local farmers and promoting sustainable trade with reliable service.

© 2025 Kingdom Hub Agro. All rights reserved.